With the ever-changing landscape of the stock market, keeping an eye on the share price trends of companies is crucial for investors looking to make informed decisions. In this detailed analysis, we delve into the recent share price trends of Hardwyn, a company that specializes in manufacturing and supplying architectural hardware products. Understanding the factors influencing the share price of Hardwyn can provide valuable insights for investors and traders alike.

Overview of Hardwyn

Hardwyn is a renowned name in the architectural hardware industry, offering a wide range of innovative products for residential and commercial spaces. The company’s product portfolio includes door handles, knobs, hinges, sliding systems, and other architectural solutions. With a focus on quality and design, Hardwyn has established itself as a trusted brand known for its durable and aesthetically appealing products.

Factors Influencing Hardwyn Share Price Trends

Several factors can impact the share price trends of Hardwyn, ranging from internal operational performance to external market dynamics. Here are some key factors to consider:

1. Financial Performance

- Revenue Growth: Increasing revenues are often positively correlated with share price appreciation.

- Profit Margins: Higher profitability can attract investors and drive the share price up.

- Earnings Per Share (EPS): Consistent growth in EPS is a favorable indicator for investors.

2. Market Conditions

- Industry Trends: Changes in the architectural hardware industry can influence investor sentiment towards Hardwyn.

- Competitive Landscape: Market competition can impact the company’s market share and pricing power.

3. Macroeconomic Factors

- Economic Indicators: Factors like GDP growth, inflation, and interest rates can affect overall market sentiment.

- Global Events: Geopolitical events and global economic trends can have ripple effects on stock prices.

4. Company Announcements and Developments

- Product Launches: Introduction of new products or services can boost investor confidence.

- Partnerships and Collaborations: Strategic alliances can enhance the company’s growth prospects.

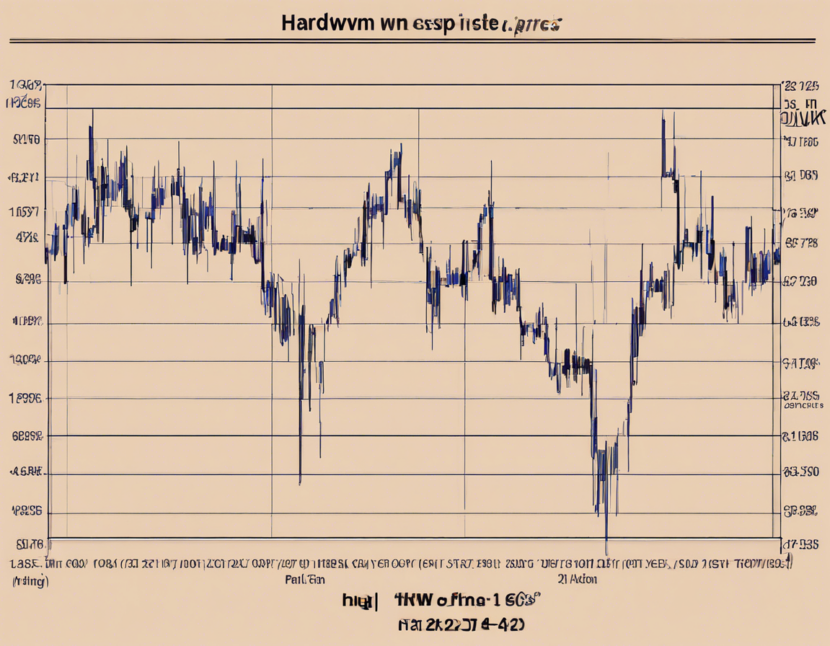

Analyzing Hardwyn Share Price Performance

To assess the recent share price trends of Hardwyn, it’s essential to conduct a comprehensive analysis using tools like technical analysis, financial ratios, and market news. By examining historical share price data and identifying patterns, investors can make data-driven decisions regarding their investment in Hardwyn.

Technical Analysis

- Utilizing technical indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands can help analyze price momentum and potential trends.

Financial Ratios

- Evaluating key financial ratios such as Price-Earnings (P/E) ratio, Return on Equity (ROE), and Debt-to-Equity ratio can offer insights into the company’s financial health.

Market News and Sentiment

- Monitoring news related to Hardwyn, including quarterly earnings reports, analyst recommendations, and market updates, can provide valuable information for investors.

Long-Term Prospects of Investing in Hardwyn

For investors considering a long-term investment in Hardwyn, it’s essential to assess not only the current share price trends but also the company’s growth potential and future prospects. Conducting thorough research on Hardwyn’s competitive positioning, industry trends, and financial stability can help investors make informed decisions that align with their investment objectives.

Key Investment Considerations

- Product Innovation: Evaluate Hardwyn’s pipeline of new products and innovations to stay competitive in the market.

- Market Expansion: Assess the company’s strategies for entering new markets and expanding its customer base.

- Financial Stability: Consider the company’s debt levels, cash flow position, and ability to generate sustainable returns for shareholders.

Frequently Asked Questions (FAQs)

1. Is Hardwyn a publicly traded company?

- Yes, Hardwyn is a publicly traded company listed on XYZ stock exchange.

2. What has been the recent performance of Hardwyn’s share price?

- The recent performance of Hardwyn’s share price has shown a gradual upward trend due to positive financial results and market sentiment.

3. How does industry competition impact Hardwyn’s share price?

- Intense competition in the architectural hardware industry can impact Hardwyn’s market share and pricing strategies, influencing its share price.

4. What are some key financial ratios to consider when analyzing Hardwyn’s share price trends?

- Investors should consider ratios like Price-Earnings (P/E) ratio, Return on Equity (ROE), and Debt-to-Equity ratio for a holistic evaluation.

5. What factors should investors focus on for long-term investment in Hardwyn?

- Investors should focus on Hardwyn’s product innovation, market expansion strategies, and financial stability for long-term investment considerations.

In conclusion, monitoring and analyzing the share price trends of companies like Hardwyn is essential for investors seeking to make well-informed investment decisions. By understanding the various factors influencing share prices, conducting thorough analysis, and assessing long-term prospects, investors can navigate the dynamic stock market landscape with confidence and clarity.